Help Protect Your

Financial Future

Help Get Peace of Mind For You and Your Family

Whether you’re planning your next big adventure or preparing for retirement, being victimized by identity theft can put your plans on hold.

Don’t let identity theft get in the way of your future.

Make the most of your milestones with Complete ID

Parents or Expecting Parents

Identity theft can strike at a young age.

- Help protect your children with Complete ID’s child identity monitoring.1

Applying for Your Driver’s License

When ID theft leads to unresolved criminal charges on your record it can prevent you from receiving a driver’s license.

- SSN monitoring can help detect cases of your identity being misused.

Preparing for College

Your application for college funds could be denied if you’re a victim of student loan fraud, and have false loans bringing down your VantageScore®2 Credit Score.

- Credit monitoring helps you to catch signs of identity theft faster.

Joining the Military

For military personnel, a clean record can be essential for their security and their career.

- Criminal record monitoring will find instances of false criminal charges and help you resolve them.

Career Growth

Identity theft impacting your reputation could be the roadblock between you and your career goals, especially if you’re applying for a job, promotion, or a work certification.

- Monitor both your legal and personal reputation with criminal record monitoring.

Preparing to Move

Looking for a new apartment or to purchase your first home? Your dream house might be kept out of reach if you have false loans in your name due to alternative loan fraud.

- Alternative loan monitoring notifies you of any alternative lending activity associated with your monitored personal information.

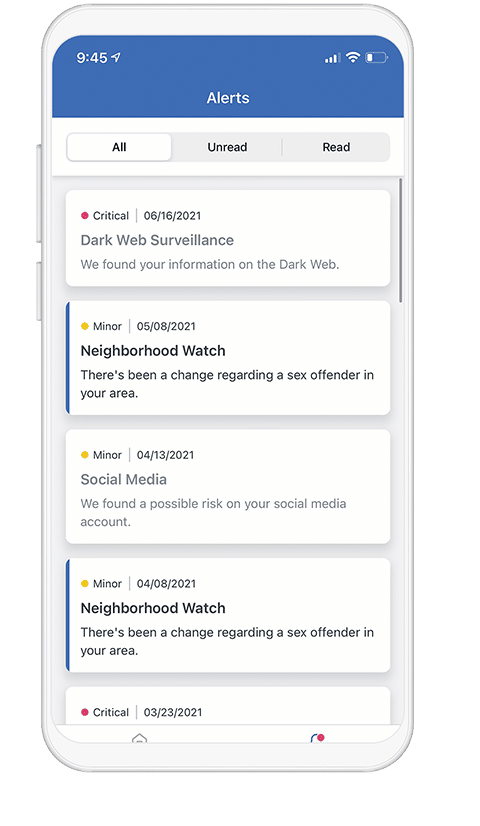

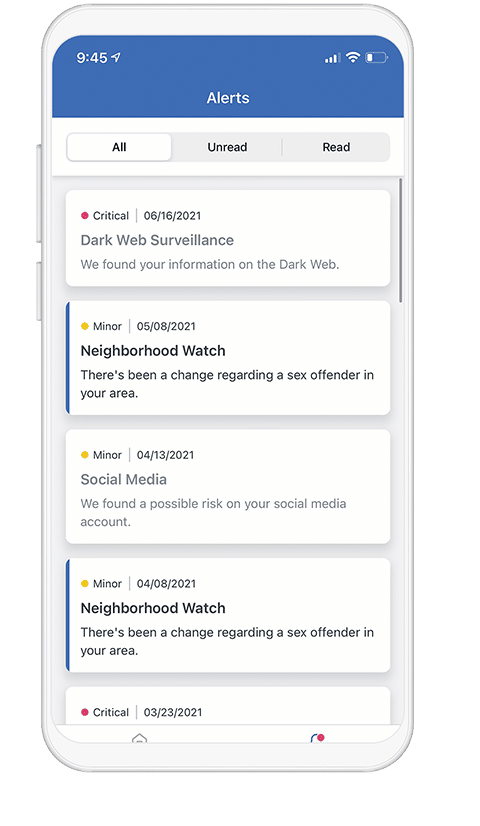

Reconnecting with Old Friends

Social media has a wonderful ability to rekindle lost connections with the people who are dear to us, but those connections can also leave us vulnerable to threats.

- Dark web surveillance will alert you if it finds compromised information that may have been exposed via social media data breaches.

Receiving Medical Treatment

Medical identity theft interferes with your medical records and insurance which can lead to incorrect treatment or inability to pay hospital bills.

- Complete ID can monitor multiple medical IDs to detect if your records are being tampered with.

Retirement

Protecting your nest egg can be difficult when faced with a case of account identity theft. Criminals can drain your funds and set your retirement plans back by years.

- Complete ID’s bank account takeover watch detects suspicious behavior to help protect your hard work.

Make the most of your milestones with Complete ID

Parents or Expecting Parents

Identity theft can strike at a young age.

- Help protect your children with Complete ID’s child identity monitoring.1

Applying for Your Driver’s License

When ID theft leads to unresolved criminal charges on your record it can prevent you from receiving a driver’s license.

- SSN monitoring can help detect cases of your identity being misused.

Preparing for College

Your application for college funds could be denied if you’re a victim of student loan fraud, and have false loans bringing down your VantageScore®2 Credit Score.

- Credit monitoring helps you to catch signs of identity theft faster.

Joining the Military

For military personnel, a clean record can be essential for their security and their career, but military members are targets of ID theft, reporting nearly 30,000 cases of imposter scams.*

- 2017 Federal Trade Commission

- Criminal record monitoring will find instances of false criminal charges and help you resolve them.

Career Growth

If you’re applying for a job, promotion, or a work certification, identity theft impacting your reputation could be the roadblock between you and your career goals.

- Monitor both your legal and personal reputation with criminal record monitoring.

Preparing to Move

Looking for a new apartment or to purchase your first home? Your dream house might be kept out of reach if you have false loans in your name due to payday loan fraud.

- Payday loan monitoring can alert you to signs of loan fraud.*

Reconnecting with Old Friends

Social media has a wonderful ability to rekindle lost connections with the people who are dear to us, but those connections can also leave us vulnerable to threats.

- Dark web surveillance will alert you if it finds compromised information that may have been exposed via social media data breaches.

Receiving Medical Treatment

Medical identity theft interferes with your medical records and insurance which can lead to incorrect treatment or inability to pay hospital bills.

- Complete ID can monitor multiple medical IDs to detect if your records are being tampered with.

Retirement

Protecting your nest egg can be difficult when faced with a case of account identity theft. Criminals can drain your funds and set your retirement plans back by years.

- Complete ID’s bank account takeover watch detects suspicious behavior to help protect your hard work.

Warning Signs of

ID Theft

play_arrow Learn More

Let Complete ID

Help

play_arrow Pricing Options

*All plan pricing is subject to applicable sales tax. Service provided by Experian®.

1Child monitoring includes up to 5 children under the age of 18. One-time Parent/Legal Guardian verification is required to receive alert details for children.

2Calculated on the VantageScore 3.0 model. Your VantageScore 3.0 from Experian® indicates your credit risk level and is not used by all lenders, so don’t be surprised if your lender uses a score that’s different from your VantageScore 3.0. Click here to learn more.