We prepare for the worst so you can live at your best

Complete ID makes the process of identity protection

simple so you can focus on more important things.

Identity Protection

Credit Monitoring

Restoration

World-Class Identity Protection

from Complete ID

- Dark Web Surveillance

- SSN Monitoring

- Neighborhood Watch

- Criminal Record Monitoring

- Alternative Loan Monitoring

- Child Monitoring1

- Financial Account Takeover Services

- Digital Identity Manager™

Credit Monitoring and Scoring

Part of a Comprehensive Plan

How often do you check your credit report? Complete ID monitors your credit for signs of fraud and alerts you when a problem is identified. Our financial dashboard also helps you monitor and improve your financial health so you can be ready to tackle your financial goals.

- Experian, Transunion and Equifax Credit Monitoring2

- Annual Tri-Bureau VantageScore®3 Credit Score

- Monthly VantageScore Credit Score powered by Experian3

- Financial Dashboard

- Credit Alerts

- Annual Three Bureau Credit Report

- Experian CreditLock™4

Restoration

Your Identity Has Been Stolen - Now What?

You don’t have to go it alone if your identity is stolen. Our restoration specialists help you tackle the process of protecting your assets and restoring your identity. If fraud occurs, you’ll have direct access to a dedicated expert and we’ll keep you up to date every step of the way.

- 24/7 Access to Our U.S. Based Support Team

- Direct Contact with Your Designated Restoration Specialist

- Up to $1,000,000 of ID Theft Insurance5

- Lost Wallet Replacement Assistance

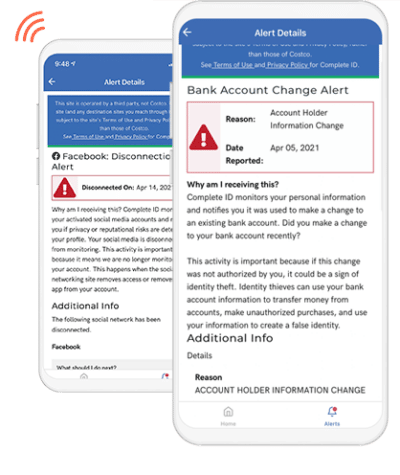

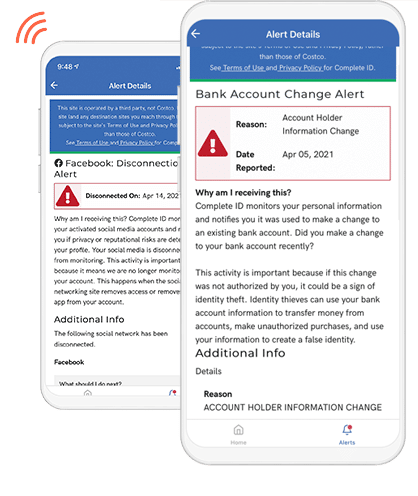

Alerts to keep you updated

STAY IN THE KNOW WHEREVER YOU ARE

With Complete ID, you can rest assured that you’ll be alerted at the first sign of trouble when there’s a threat to your identity.

Alert Types:

- Credit Monitoring Alerts

- Criminal Record Alerts

- Financial Account Alerts

- Dark Web Alerts

- Mail Change Alerts

- Neighborhood Watch Alerts

- Alternative Loan Alerts

- SSN Alerts

Child Identity Monitoring

HELP PROTECT YOUR CHILD’S FUTURE

Complete ID’s child identity monitoring feature can cover up to five children and includes social media monitoring, dark web scanning, and checks for fraudulent names, addresses, and aliases associated with your child’s Social Security number. With child monitoring from Complete ID, you’ll receive alerts and instructions as well as restoration assistance so you can easily stay informed on your child’s identity health.1

Key features from protection to restoration, Complete ID is there for you

Identity Protection

Identity Protection

You can’t always stop ID theft, but Complete ID’s extensive monitoring is here to help

Credit Monitoring & Scoring

Credit Monitoring & Scoring

Complete ID will monitor your credit score and give you access to reports from major credit bureaus

Restoration Services

Restoration Services

We’ll be there to handle your case fast so you can get back on your feet

Resolving your case when identity theft strikes

As a Complete ID member, you won’t get rung out by all the fees that come along with restoration. Our plan of up to one million dollars of identity theft insurance5 will help ease the stress of restoration by covering:

- Lost wages or income

- Attorney and legal fees

- Any expenses for refiling loans, grants, and other lines of credit

- Costs of childcare and/or elderly care

*All plan pricing is subject to applicable sales tax. Service provided by Experian®.

1Child monitoring includes up to 5 children under the age of 18. One-time Parent/Legal Guardian verification is required to receive alert details for children.

2Monitoring with Experian begins within 48 hours of enrollment in Complete ID. Monitoring with Equifax and TransUnion takes approximately 4 days to begin. You may cancel your membership in Complete ID any time online or by calling 1-855-591-0202.

3Calculated on the VantageScore 3.0 model. Your VantageScore 3.0 from Experian indicates your credit risk level and is not used by all lenders; your lender may use a score that’s different from your VantageScore 3.0. Click here to learn more about this.

4Experian CreditLock™ is a separate service from Security Freeze and is an included feature in all Complete ID membership plans. This feature controls access to your Experian credit file and will not apply to your TransUnion or Equifax credit files. To learn more about Experian CreditLock and view the differences between a Security Freeze, Experian CreditLock, and Fraud Alerts please visit www.completeid.com/frequently-asked-questions.

5The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company under group or blanket policy(ies). The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.